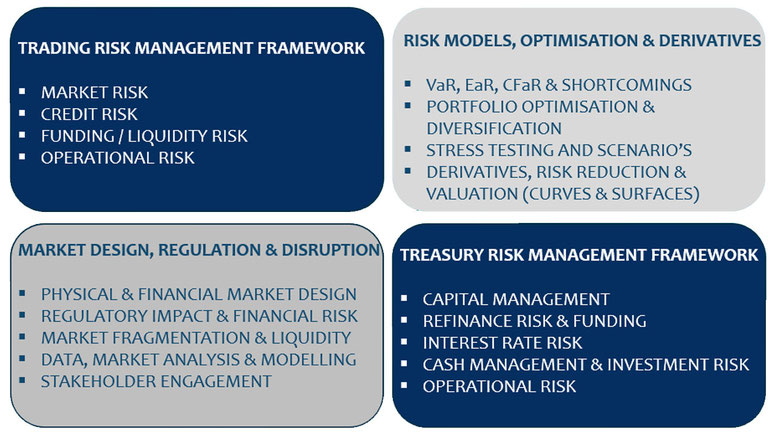

Solutions are outcomes providing Boards and Risk Committees with confidence that internal risk frameworks are fit-for-purpose, effective, and efficient

in:

- aligning capital structure, target credit rating, and attitudes and appetite for risk

- bettering shareholder returns on risk adjusted capital

- re-aligning operating models with corporate purpose and intent

WOOLLAHRA refers to meeting ground / sitting place / camp site; symbolic for how Industry Partnerships precipitate trust, synthesize ideas and implement solutions: the spirit of Partnership.

Physical and Financial markets present risk and gain: at times exhibiting a lack of liquidity / depth and opaqueness to those not transacting. Inherent basis risks require pricing of geographic, product and time basis; whilst internal risk off-sets from embedded portfolio flexibility (i.e. real options) reduce need for costly external hedging to:

- maintain optimal capital structure and fund investments / operations

- structure the long volatility portfolio position by executing in emergent financial markets

- price the full suite of physical / financial customer services and inventory funding solutions

Real value is derived from funding projects / operations efficiently; facilitated by effective Treasury Risk Frameworks (i.e. people, policies, processes, systems). Treasuries house financial risk competencies in evolving corporations and are responsible for Capital Management, Funding / Refinancing, Cash and Investment Risks. The Treasury blueprint embeds funds transfer pricing and capital allocation to gauge overall corporate financial performance.

Absent Global coordinated agreement on carbon emissions sees ongoing cascade of national / state based schemes fill the void; driven by Policy initiatives, technological learning curves and commercial adaptation. Prevailing renewable technologies are non-firm in nature and require efficient flexible capacity and network connection. The Energy Trilemma involves transition to sustainable energy at efficient reliability and cost. Transition may be slow to arrive but will seem fast in passing.